Is Amazon, the colossal e-commerce and cloud computing titan, truly living up to its potential, or are whispers of stagnation beginning to surface? With recent financial reports revealing both impressive gains and cautionary signals, the answer, as always, is complex, demanding a deep dive into the numbers and the narratives shaping the company's future.

Amazon.com, Inc. (NASDAQ: AMZN) recently unveiled its financial performance for the first quarter, concluding on March 31st. The figures tell a story of resilience and growth, yet also hint at the challenges the company navigates in an ever-evolving marketplace. Net sales for the quarter surged to $155.7 billion, representing a 9% increase compared to the $143.3 billion recorded in the corresponding period last year. Adjusting for the $1.4 billion unfavorable impact of fluctuating foreign exchange rates, the growth rate nudges up to a commendable 10%. These figures, however, only paint a partial picture; a deeper examination is needed to comprehend the intricacies of Amazon's present state.

| Financial Metric | Q1 2024 | Q4 2024 |

|---|---|---|

| Net Sales (USD Billion) | $155.7 | $187.8 |

| Net Sales Growth (YoY) | 9% (10% ex. FX) | 10% (10% ex. FX) |

*Note: This is based on the provided context and simplified for illustrative purposes. Specific figures like Net Income, Operating Income etc. can be added in the real scenarios.*

The financial disclosures from Amazon also illuminate a fascinating tale of quarterly evolution. For the final quarter of 2024, ended December 31st, the company’s performance was equally noteworthy. Net sales escalated by 10% to $187.8 billion, a clear demonstration of Amazon’s enduring strength during the holiday shopping season. Accounting for the $0.9 billion negative impact of foreign exchange fluctuations, the adjusted sales growth maintained its 10% trajectory, illustrating Amazon’s continued ability to expand globally.

Beyond the headline figures, Amazon’s earnings reports often serve as a bellwether for broader economic trends, especially within the retail and cloud computing sectors. The company's performance, including its earnings per share (EPS), which often provides insights into investor confidence and overall profitability, are closely scrutinized by industry analysts and investors alike. For the initial quarter of 2025, market analysts projected an EPS of $1.37, and a revenue of $155.04 billion, a prediction that highlights the financial landscape that Amazon is maneuvering through.

The company's strategies are now evolving; Amazon has consistently invested in innovation, introducing new models in Amazon Bedrock, including Anthropic's Claude 3.7 Sonnet, DeepSeek's R1, Meta's Llama 4 family of models, and Mistral AI's Pixtral Large. Further advancements include the general availability of Amazon SageMaker Unified Studio for data engineers, which aims to streamline data access and collaboration. These developments reflect Amazon's commitment to staying ahead in the fields of artificial intelligence and machine learning, enhancing the capabilities it offers to consumers and businesses alike.

One of the intriguing aspects of Amazon's journey is the intersection of its business operations with the broader global economic and political landscape. Amazon’s financial outcomes and strategic direction have been influenced by trade policies and international relations. A specific instance can be seen in the potential effect of tariffs. For example, the impact of a 10% tariff on Chinese imports imposed by a former U.S. President, has the potential to significantly influence Amazon's supply chain and profitability. Such external influences demand constant adaptability from the company.

During Q4 of 2024, Amazon revealed noteworthy profit metrics. Net profits hit $20 billion, while earnings per share reached $1.86, outperforming the $1.49 anticipated by analysts. These results highlight Amazon's ability to generate high profits. Yet, the market’s reaction wasn’t uniform, as the stock faced a dip partly due to the company's outlook for the future, emphasizing the need for a nuanced understanding of the market's views on Amazon’s long-term potential.

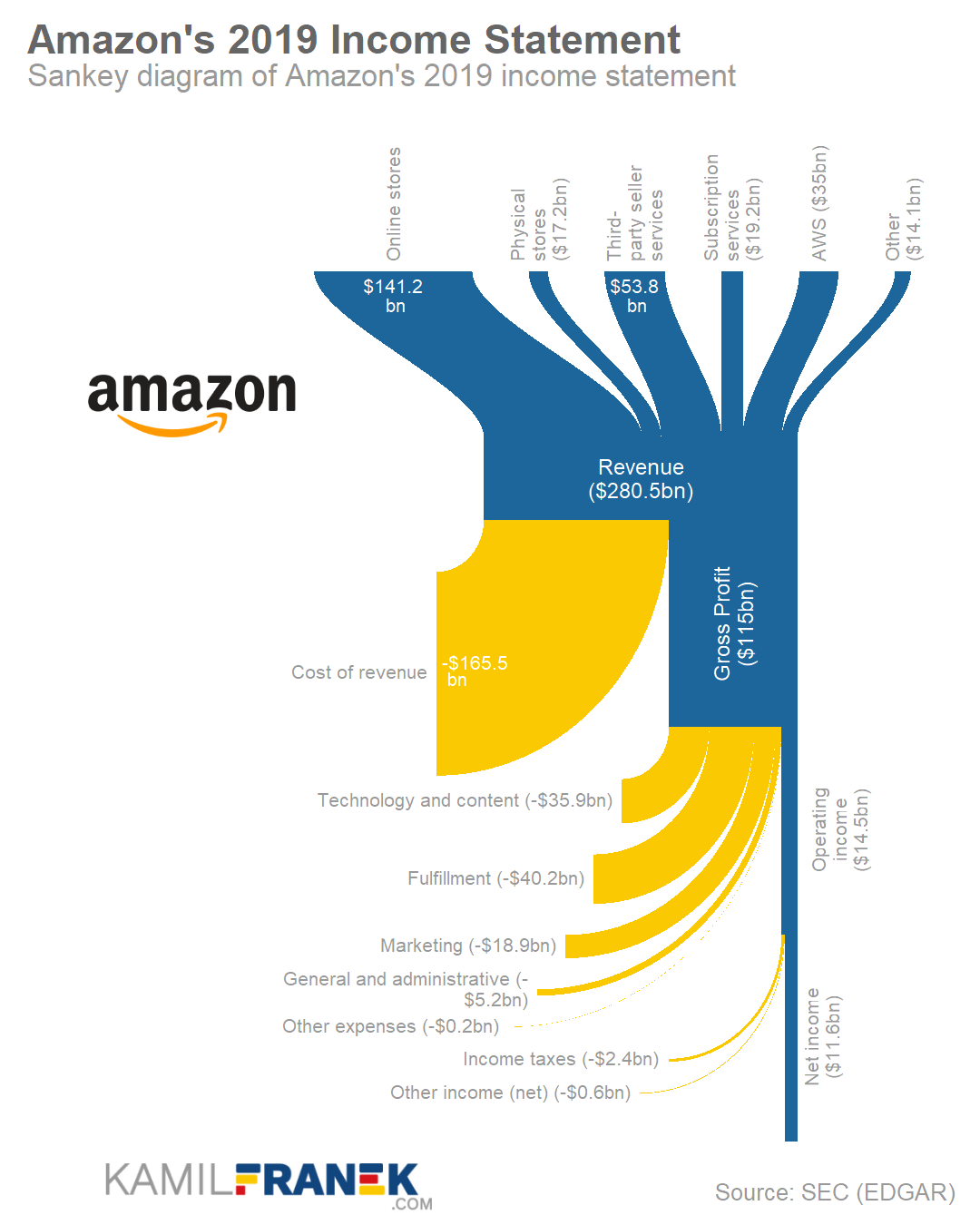

Amazon’s trajectory is also shaped by its vast array of diverse business divisions. From its core e-commerce operations and its cloud computing services to its advertising and physical store ventures, the company’s diversified strategy has been a key factor in its financial successes. This expansive model allows Amazon to spread its risks across numerous income streams, rendering it somewhat resilient to single-sector fluctuations. The e-commerce segment, for instance, confronts the ever-changing dynamic of consumer preferences, and the cloud computing segment faces competition from rivals. Each facet of its diverse offerings has its own strategic challenges and opportunities.

When considering the latest financial results, it is apparent that Amazon is at a pivotal moment in its corporate history. Although net sales have increased and the company still shows considerable profitability, there are many factors influencing its potential for future growth. Understanding the intricacies of Amazon’s business model, adapting to shifting consumer trends, navigating geopolitical complexities, and continuously innovating are crucial to the company’s future performance and its position in the global marketplace.

A deeper dive into the specifics of Amazon’s financial outcomes reveals a series of complex factors that shape its current performance. The revenue figures from the first quarter of 2024 are noteworthy. While the 9% rise in net sales is impressive, it is important to note that, the reported figures need to be viewed with nuance, considering elements such as foreign exchange rates and economic changes. This illustrates the complexities of managing a global business in a fluctuating financial environment. The fourth-quarter results from 2024, which showed a 10% rise in net sales, additionally emphasize the need for adaptive strategies in the face of seasonal demand fluctuations and macroeconomic difficulties.

The market reaction to Amazon’s financial disclosures also points to crucial areas of concern. While impressive earnings were reported for Q4 2024, the stock price experienced a dip, reflecting a cautious attitude among investors regarding the company's future trajectory. These market signals highlight the necessity for Amazon to effectively communicate its long-term plan and to navigate the ever-changing expectations of investors and analysts. This shows how pivotal it is for Amazon to balance its short-term objectives with a long-term vision.

The future trajectory of Amazon is closely linked to its ability to innovate and its expansion into fresh markets. The company’s move towards advanced technologies, especially AI and machine learning, shows a commitment to staying at the forefront of technological innovation. The introduction of new foundation models, along with tools like Amazon SageMaker Unified Studio, show Amazon’s intent to reinforce its position in the market. The effectiveness of these measures will play a pivotal role in the company's future profitability and competitiveness.

External factors such as trade policies and global economic conditions also have a significant effect on Amazon's business. The impact of tariffs and other trade-related issues highlights how important it is for the company to adapt and adjust to shifting global trends. Amazon's ability to manage its supply chains and mitigate the effects of global instability will be key to maintaining its financial performance.

In conclusion, Amazon's financial reports from the first quarter of 2024, combined with the preceding data from Q4 2024, provide a comprehensive view of the company's current state. Although the figures highlight growth and profits, challenges such as economic issues, market dynamics, and external forces require strategic adaptability and foresight. Amazon's capacity to use its resources, foster innovation, and efficiently respond to global issues will determine its path. Amazon’s future prospects will be defined by its strategic vision, financial acumen, and capacity to navigate the complex global landscape.