Can Apple's financial prowess truly defy the economic gravity, or are the record-breaking figures just a fleeting moment in the tech giant's history? The recent financial results, particularly from the first and second quarters of 2025, paint a picture of unprecedented success, but also raise critical questions about sustainability and future growth.

The numbers, as they say, speak for themselves. Apple's performance in the first quarter of 2025 was nothing short of spectacular. The company unveiled a revenue of $124.3 billion, a figure that not only surpassed expectations but also etched its name in the history books as Apple's most profitable quarter ever. This impressive revenue translated into a staggering profit of $36.3 billion, a testament to the company's operational efficiency and market dominance. Driving this financial triumph was the robust performance of several key segments, including Services, Mac, and iPad. Furthermore, Apple's strategic moves, such as the unveiling of Apple Intelligence, a new AI platform designed with a strong emphasis on privacy, and its expansion into additional languages in April, demonstrate a forward-thinking approach that could solidify its position in the rapidly evolving tech landscape.

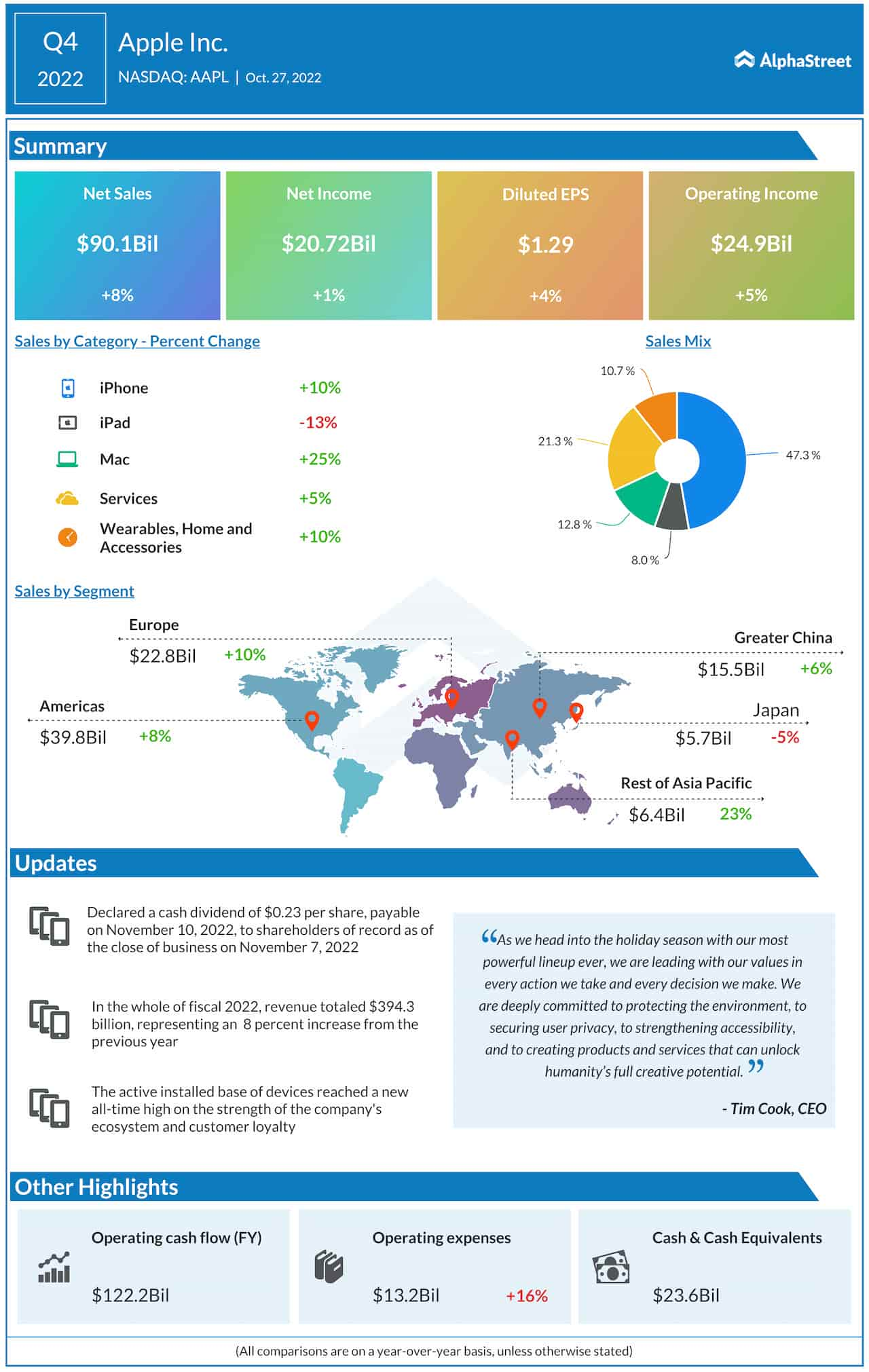

To provide a clearer picture of Apple's recent financial performance, here's a detailed breakdown:

| Metric | Q1 2025 | Q2 2025 | Q4 2024 |

|---|---|---|---|

| Revenue | $124.3 billion | $95.4 billion | $94.93 billion |

| Profit | $36.3 billion | $24.8 billion | N/A |

| Year-over-year Revenue Growth | N/A | 5% | 6% |

| Diluted Earnings per Share | N/A | $1.65 | N/A |

| Key Developments | Apple Intelligence launch, expanded language support | Focus on financial results | iPhone 16 and other new product launches |

Apple's momentum continued into the second fiscal quarter of 2025, albeit at a slightly moderated pace. The company announced financial results for the second fiscal quarter, which aligns with the first calendar quarter of the year. While not as groundbreaking as the previous quarter, the results remained strong, with a revenue of $95.4 billion. This represented a 5 percent increase year-over-year. The diluted earnings per share also saw an impressive 8 percent year-over-year increase, reaching $1.65. These figures, even amidst the inherent volatility of the global market, are a solid indicator of Apple's resilience and its ability to adapt to evolving consumer preferences and economic conditions.

Further evidence of the company's remarkable financial health can be found in its fourth-quarter earnings for fiscal year 2024. The company reported a revenue of $94.93 billion, marking a 6% year-over-year increase. The report also highlights that Apple introduced the iPhone 16 and other new products. Though the company also faced a considerable tax charge, the overall performance was a testament to its effective product lifecycle management and its successful strategies in navigating a complex market environment.

While the numbers are undeniably impressive, a closer look reveals some potential headwinds. Analysts, including those at Goldman Sachs, were anticipating Apple to exceed earnings per share expectations of $1.61 and revenue projections of $94.0 billion in the second quarter. The company also faced the scrutiny of potential tariff costs and challenges in the Chinese market, which are concerns raised by CEO Tim Cook. These factors highlight the complex interplay of global economics and company performance.

These impressive figures have led investors and analysts to scrutinize the long-term sustainability of Apple's success. The question is not whether Apple is currently doing well, but whether it can maintain this trajectory in the face of rapidly changing market dynamics. The company's ability to innovate and adapt, its strategic investments, and its capacity to navigate global economic uncertainties will be pivotal in determining its future performance.

In addition to its financial achievements, Apple's commitment to innovation is noteworthy. The introduction of Apple Intelligence signifies the company's strategic direction toward AI, a field poised to revolutionize several industries. The expansion of its products and services into new languages also points toward an increasingly global focus, demonstrating the company's dedication to reaching a wider audience.

The remarkable performance of Apple in the first and second quarters of 2025 underscores its robust financial health. The company's ability to generate record-breaking revenue and substantial profits, coupled with its strategic initiatives in AI and global expansion, places it in a strong position. However, the challenges of global economic factors, tariff costs, and market dynamics emphasize the need for careful navigation and sustained innovation to maintain its success. Investors and observers will continue to watch Apple closely, seeking to gauge the company's capacity to sustain its achievements in the years to come.

For more information, visit the Investor Relations section of Apple's website to access quarterly earnings reports.