Is MicroStrategy (MSTR) the future of corporate Bitcoin investment, or simply a volatile gamble? The company’s unwavering commitment to Bitcoin, even amidst market fluctuations, has fundamentally altered its identity, transforming it from a business intelligence firm into a publicly traded proxy for the cryptocurrency itself.

For investors seeking exposure to Bitcoin without directly holding the digital asset, MicroStrategy (MSTR) has become a prominent, if somewhat controversial, choice. The company, led by its outspoken and highly visible Executive Chairman, Michael Saylor, has aggressively converted its treasury into Bitcoin, viewing the cryptocurrency as a superior store of value compared to traditional assets. This strategy, however, has subjected the company's stock to the extreme volatility inherent in the Bitcoin market, creating both opportunities and risks for its shareholders.

To better understand the driving force behind this significant shift in corporate strategy, consider a closer look at the key figure:

| Category | Details |

|---|---|

| Name | Michael J. Saylor |

| Title | Executive Chairman of MicroStrategy |

| Date of Birth | February 4, 1965 |

| Education | Massachusetts Institute of Technology (MIT), Bachelor of Science in Aeronautics and Astronautics and Bachelor of Science in Technology of Management |

| Key Accomplishments | Co-founded MicroStrategy in 1989; Led MicroStrategy's transformation into a major corporate Bitcoin holder; Authored The Mobile Wave: How Mobile Intelligence Will Change Everything. |

| Career Highlights | Founder and CEO of MicroStrategy (1989-2022); Currently Executive Chairman of MicroStrategy; Advocate for Bitcoin adoption. |

| Bitcoin Holdings | MicroStrategy holds a significant amount of Bitcoin as part of its corporate strategy. (Exact holdings fluctuate; check official filings.) |

| Public Statements | Known for his strong advocacy for Bitcoin, frequent public appearances, and use of social media to promote Bitcoin. |

| Controversies | Saylor has faced scrutiny regarding his influence over MicroStrategy’s Bitcoin strategy and the company's financial decisions. |

| Link to Authentic Website for Reference | MicroStrategy Official Website |

The path to acquiring shares of MicroStrategy (MSTR) is relatively straightforward. The stock can be purchased through any established online brokerage account. Major platforms like Charles Schwab, E*TRADE, Fidelity, and Vanguard Brokerage Services, among others, provide access to the U.S. stock market, allowing investors to readily participate in the trading of MSTR shares. The ease of access underscores the widespread acceptance of MicroStrategy as a publicly traded entity, despite its unconventional investment strategy.

Analyzing the real-time stock performance of MSTR provides critical insights into the company's financial health and market perception. Platforms such as Google Finance offer up-to-the-minute quotes, historical data, and interactive charts. These tools assist in making informed decisions about investments by allowing investors to track the stock's performance against the backdrop of market trends and company-specific news.

Morningstar provides a comprehensive perspective on MSTR, classifying the company as a bitcoin treasury company and a provider of business intelligence services. This classification highlights the dual nature of MicroStrategy's business. The platform provides crucial metrics such as stock price, quantitative ratings, valuation assessments, financial data, dividend information, and ownership structures, enabling investors to gain a detailed understanding of the company's standing within the market.

For those looking for immediate, real-time data, Nasdaq provides a dynamic platform. Investors can monitor live data, including the stock price, trading volume, high and low values for the day, and the 52-week range. Furthermore, the ability to track pre-market and after-hours trading allows investors to react to market fluctuations outside of regular trading hours. Nasdaq's platform serves as an important resource for keeping pace with the volatile nature of MSTR's performance.

Investing.com offers a streamlined interface for tracking MSTR's performance, presenting the stock's current price alongside the latest news and analysis. The ability to set up real-time notifications for any changes in stock price allows investors to stay informed and make proactive decisions. This reactive capability is critical, especially in the fast-paced environment of cryptocurrency-linked stocks.

MarketWatch offers a comprehensive financial overview of MicroStrategy, providing real-time stock prices and quotes, and detailed financial data. This comprehensive data set helps investors to assess the company’s financial health and its position within the broader market. Access to this extensive information stream is essential for informed decision-making.

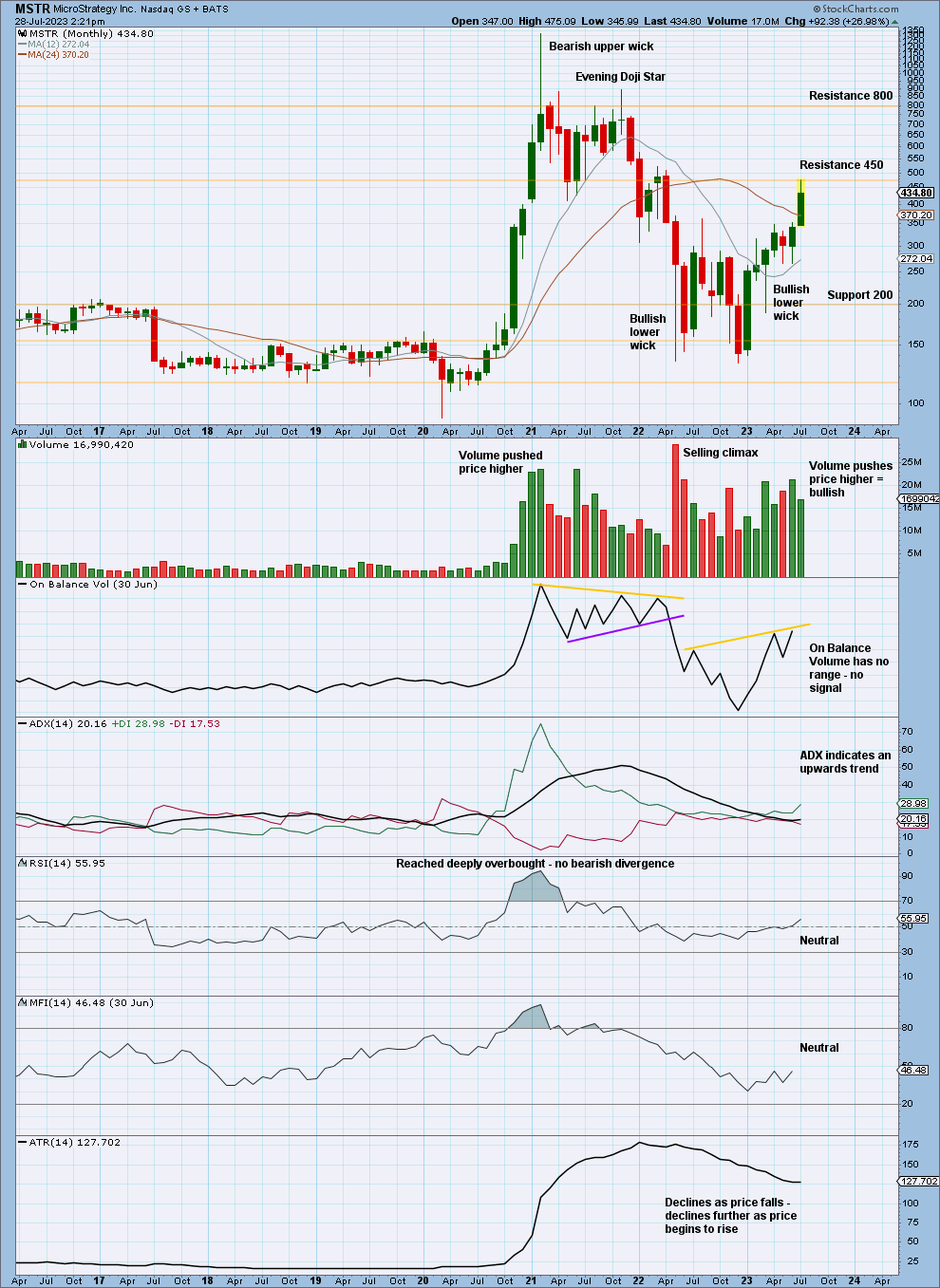

The fluctuating price of MSTR is intrinsically linked to the performance of Bitcoin. Its movements, highs, and lows are often dictated by broader market sentiment, regulatory developments, and technological advancements within the cryptocurrency space. MicroStrategy's stock price, therefore, is subject to amplified volatility when compared to more traditional stocks. This characteristic makes MSTR a higher-risk, higher-reward investment, appealing to investors with a higher tolerance for risk and a bullish outlook on Bitcoin's future.

The financial performance of MicroStrategy (MSTR) directly reflects the value of its Bitcoin holdings. As Bitcoin's price changes, so too does MicroStrategy's balance sheet and, consequently, its stock price. This interdependence means that any significant shifts in the Bitcoin market have a direct and often immediate impact on MSTR's value. Fluctuations can be rapid and substantial, underscoring the need for investors to remain constantly informed.

News and analysis of MSTR is crucial for investors. A constant stream of information is accessible through various news sources and financial analysis websites. These channels furnish insights on market trends, expert opinions, and company-specific developments. Monitoring these sources enables investors to better understand the factors influencing the stock price and anticipate potential shifts.

The narrative surrounding MicroStrategy is dominated by Bitcoin. The company's identity is now inextricably linked to the cryptocurrency, and its success is significantly dependent on the future trajectory of Bitcoin. This commitment has made it a unique investment opportunity, particularly for investors who believe in Bitcoin's long-term viability and are comfortable with the inherent volatility.

MicroStrategy's future is essentially intertwined with Bitcoin's. The company's strategic commitment to the cryptocurrency suggests a long-term belief in its potential. Investors must assess their own risk tolerance, their understanding of Bitcoin, and their confidence in MicroStrategy's leadership and its ability to navigate the complexities of the cryptocurrency market. The decision to invest in MSTR is not just a bet on a company, but a bet on the future of Bitcoin itself.