Is MicroStrategy (MSTR) poised to revolutionize the financial landscape, or is its foray into the world of Bitcoin a high-stakes gamble? The company's recent performance, coupled with the fluctuating price of Bitcoin, presents a compelling narrative of innovation, risk, and the potential for substantial returns.

MicroStrategy Incorporated (MSTR), a company initially known for its business intelligence software, has aggressively pivoted its strategy to embrace Bitcoin. This bold move has captured the attention of investors and analysts alike, leading to both fervent endorsements and cautious skepticism. The firm's commitment to acquiring and holding Bitcoin as a primary treasury reserve asset has dramatically reshaped its financial profile and market perception. However, the inherent volatility of Bitcoin adds a layer of complexity to evaluating the company's true worth and future prospects.

To understand the intricacies of MicroStrategy's (MSTR) position in the market, here's a breakdown of key information:

| Category | Details |

|---|---|

| Company Name | MicroStrategy Incorporated |

| Ticker Symbol | MSTR |

| Industry | Software (Business Intelligence), Bitcoin Holdings |

| Business Focus | Providing business intelligence, mobile software, and cloud-based services. Significant holdings of Bitcoin as a treasury asset. |

| Recent Developments | Aggressive Bitcoin acquisition strategy. Focus on leveraging Bitcoin holdings and promoting its technological advancements. |

| Stock Price Performance | Subject to significant volatility due to Bitcoin price fluctuations and market sentiment. |

| Analyst Ratings | Varying, with some analysts recommending Strong Buy while others express caution. Consensus price targets are available, but should be taken with consideration of the inherent market risks. |

| Trading Platforms | Traded on NASDAQ (Nasdaq: MSTR) and other major exchanges. Accessible through online stock brokers. |

| Key Financial Metrics | Focus on revenue from software licenses, subscription services, and the impact of Bitcoin holdings on balance sheets and earnings. |

| Dividend Information | No recent history of dividend payments. |

| Ownership | Institutional ownership and insider activity are closely monitored by analysts. |

| Risks | Bitcoin price volatility, regulatory changes impacting cryptocurrencies, and the competitive landscape of the software and business intelligence sectors. |

| Further Information | Consulting websites such as Yahoo Finance, Google Finance, Morningstar, Nasdaq and TradingView to get detailed information. |

| Website for Reference | MicroStrategy Official Website |

The convergence of software innovation and the burgeoning world of digital assets has presented unique challenges and opportunities for MicroStrategy. The fluctuating value of Bitcoin has become inextricably linked to the company's stock performance, creating a high-stakes scenario for investors. The integration of Bitcoin into its corporate strategy has fundamentally altered how the market perceives MicroStrategy.

The shift towards Bitcoin holdings has significantly influenced the company's financial statements, particularly the balance sheet and income statement. The impact of Bitcoin's price fluctuations directly affects the company's asset valuations and, consequently, its earnings reports. This makes it imperative for investors to closely monitor Bitcoin's market behavior when analyzing MicroStrategy's financial health. This dependency on the volatile cryptocurrency also raises concerns about the company's long-term stability and its susceptibility to market downturns.

Analysts have voiced a range of opinions regarding MicroStrategy's future prospects. Some view the company's Bitcoin strategy as a bold and visionary move, anticipating substantial returns as Bitcoin's value potentially increases. The bullish outlook is supported by the long-term potential of Bitcoin and the company's significant holdings. Conversely, other analysts remain more cautious, emphasizing the inherent risks associated with Bitcoin's volatility and the potential for market corrections. This divergence in perspectives underscores the importance of conducting thorough research and due diligence before making any investment decisions regarding MSTR.

Obtaining real-time data on MSTR stock, including price, volume, and trading ranges, is easily accessible through platforms like Nasdaq. These platforms allow investors to track the stock's performance in both pre-market and after-hours sessions. This constant stream of data empowers investors with the knowledge needed to make well-informed decisions, reacting to market trends and price movements efficiently. The ease of access to market data is a critical component for anyone trading in the stock market, especially when dealing with a company like MicroStrategy, where the stock price is significantly impacted by external factors.

Trading MSTR stock, like other publicly traded securities, requires opening an account with an online stockbroker. This process generally involves following the broker's procedures and adhering to regulatory requirements. Once the account is set up, investors can buy and sell MSTR shares. This straightforward method of accessing the stock market provides individuals with the tools necessary to participate in the dynamic environment of stock trading, and track the stock's performance against other assets.

The company's performance, and the price of MSTR, are subjects of comprehensive coverage across financial platforms such as Yahoo Finance, Google Finance, Morningstar, and TradingView. These resources provide a wealth of information, including real-time stock prices, historical performance data, technical analysis tools, and financial news updates. By accessing these platforms, investors can gain a deeper understanding of MicroStrategy's position within the market, track its performance, and stay informed about industry trends. This continuous flow of information is critical for making informed investment decisions, especially when navigating the complexities of a market influenced by both traditional financial instruments and the volatility of cryptocurrencies.

Morningstar provides quantitative ratings and valuations for MSTR, offering investors a deeper look into the financial health and future prospects of the company. These ratings, along with detailed financial statements, dividend information (if applicable), and ownership data, are critical to making decisions. This detailed information helps investors evaluate the fundamentals of MicroStrategy and assess its value in the current market conditions.

Understanding the risks associated with investing in MSTR is crucial. The primary risk is the volatility of Bitcoin, as its price swings can significantly affect MicroStrategy's stock price and financial performance. Regulatory changes related to cryptocurrencies also pose a threat, as new laws or policies could impact Bitcoin's value and MicroStrategy's business model. Furthermore, the competitive landscape within the software and business intelligence sectors adds to the complexity, with rivals constantly striving to innovate and capture market share. Investors must carefully weigh these risks when evaluating MicroStrategy as a potential investment.

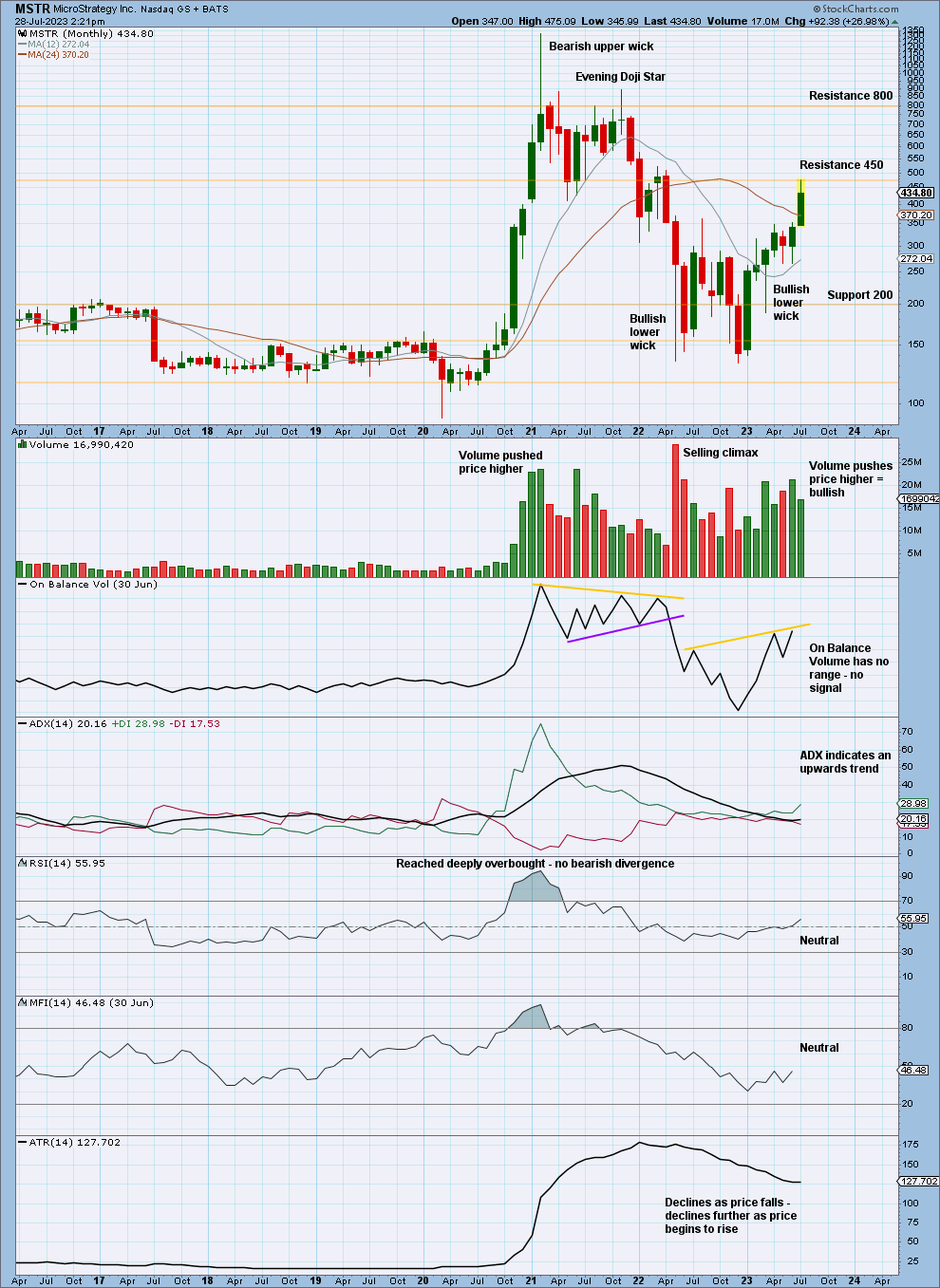

Interactive stock charts available on platforms such as Stock Analysis offer real-time updates and full price history, as well as tools for technical analysis. These allow investors to see historical data. The availability of detailed charts and analysis tools enables investors to track trends, identify potential entry and exit points, and make informed decisions based on past performance and market indicators.

The market's valuation of MicroStrategy is a subject of debate. With its significant Bitcoin holdings, the company's valuation is heavily influenced by the price of the cryptocurrency. Investors and analysts use a variety of methods, including price-to-earnings ratios and discounted cash flow analysis, to estimate MicroStrategy's true value. However, due to Bitcoin's unpredictability, these valuations are often accompanied by considerable uncertainty.

The average rating for MSTR stock, based on the assessment of multiple analysts, frequently is Strong Buy, showing the prevailing sentiment among experts. The price forecasts and recommendations should be considered as predictions, not guarantees. The opinions of industry experts can serve as one data point for investors.

In conclusion, MicroStrategy (MSTR) represents a fascinating and intricate investment opportunity. The company's aggressive embrace of Bitcoin, combined with its established business intelligence services, presents a unique mix of growth potential and risk. Investors should conduct thorough research, stay informed about market trends, and carefully assess their risk tolerance before making any investment decisions regarding MSTR. The dynamic interplay between software, Bitcoin, and market sentiment will continue to shape MicroStrategy's trajectory, making it a company well worth monitoring for those interested in the future of finance.