Are you prepared for the upcoming changes in your Social Security payments? May 2025 brings a unique scheduling quirk for Supplemental Security Income (SSI) recipients: two payments within the month, a significant adjustment that warrants careful attention.

The intricacies of the Social Security payment schedule can often feel like navigating a complex maze. Understanding the dates, the amounts, and the specific circumstances that govern your benefits is crucial for effective financial planning, particularly for those relying on these funds for essential living expenses. The upcoming month of May presents a specific scenario that requires a thorough understanding of the payment schedule to avoid any confusion or potential financial disruption.

To fully grasp the implications of these changes, consider this comprehensive overview that aims to clarify the payment schedule for May 2025, with specific attention to SSI recipients. This information is especially pertinent for those who are reliant on these benefits for their livelihood, as it ensures you are well-informed and prepared for the incoming payments.

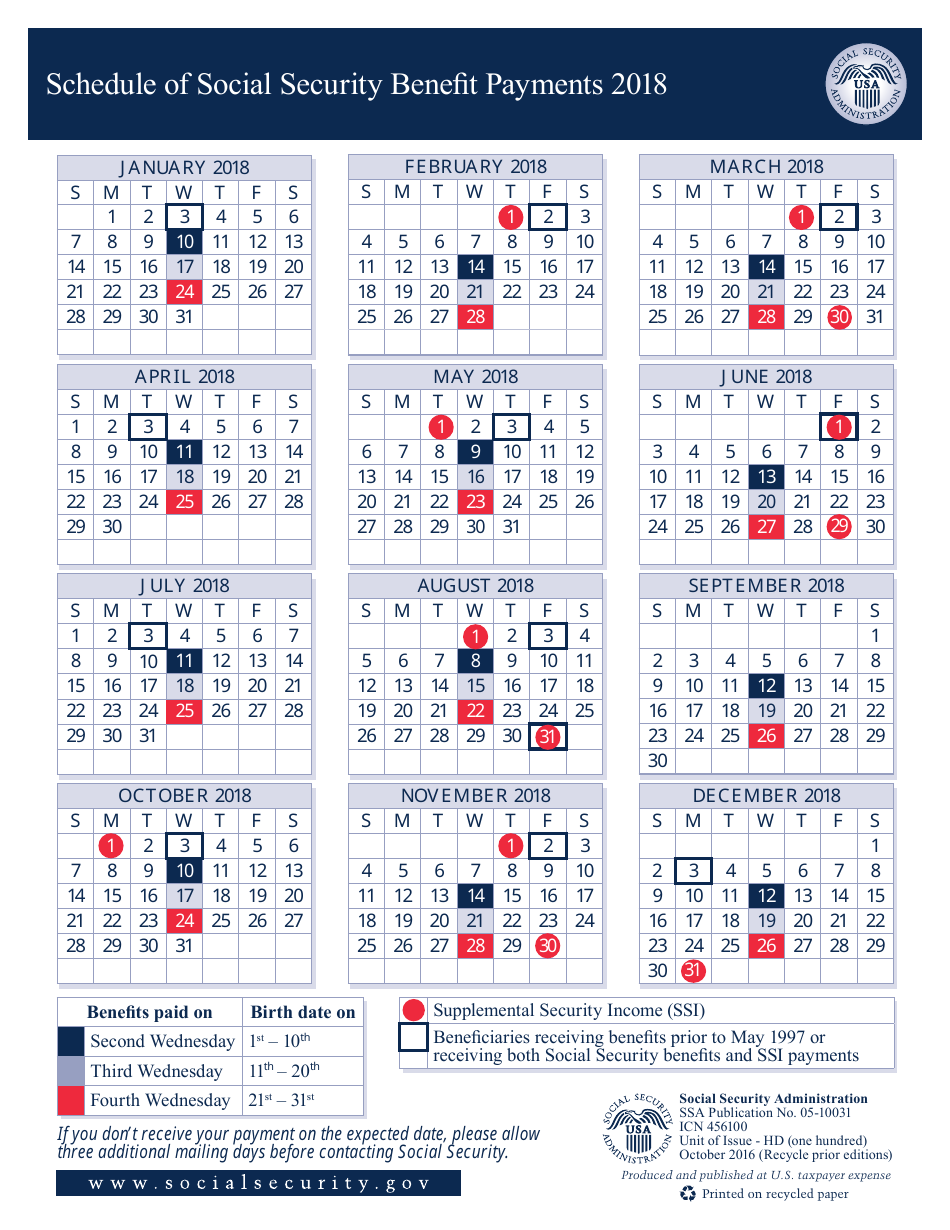

The first payment for SSI recipients is scheduled for **May 1st**. This check represents the regular benefit for the month of May. The second SSI payment will be issued later in the same month due to the standard schedule, which will be issued on **May 31st**. This may come as a surprise to some, so it is important to take note of these dates. This may occur because the last day of the month has a holiday, or the start of the month had a holiday. For those receiving both SSI and Social Security, or those who started receiving Social Security before May 1997, their payments may follow a slightly different schedule. People in this group usually receive their SSI payment on the first and their Social Security benefit on the third of the month.

For those receiving regular Social Security retirement benefits, the payments in May 2025 will follow the standard schedule, with retirees receiving payments on the 14th, 21st, or 28th of the month, depending on their birth date. It’s worth noting that the average Social Security retirement benefit hovers around $1,950. The maximum benefit can reach a considerable amount, which is adjusted annually.

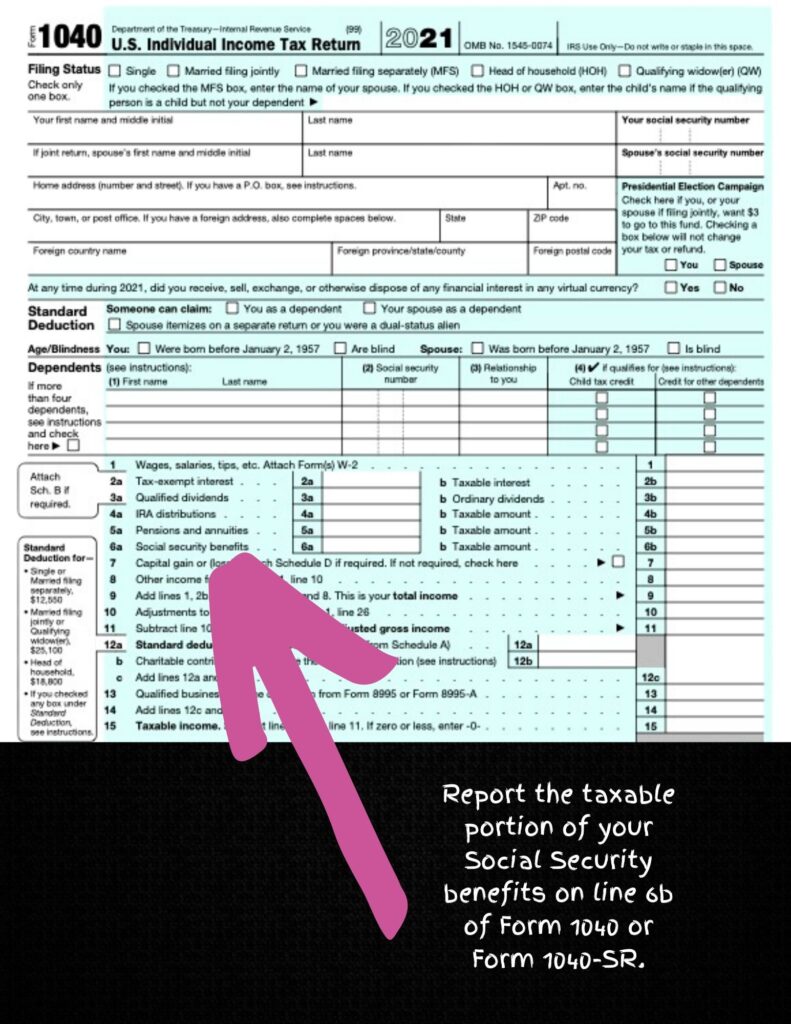

The implementation of the Social Security Fairness Act has had a direct impact on some recipients. Those who previously had their public sector pension restricted due to the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) saw their benefits updated in April. If you are affected by these provisions, it’s essential to review your payments and ensure they reflect the updated calculations.

To stay informed and keep track of your payments, the Social Security Administration (SSA) offers a variety of resources. The application process for SSI benefits can be initiated online, in person at your local Social Security office, or by calling 1-800-772-1213 (TTY 1-800-325-0778) from 8 a.m. to 7 p.m. local time. Utilizing these resources can provide clarity and peace of mind. Further guidance and access to benefit information can be found through the SSA website. You can use the online portal to view your payment history and account information.

The adjustments to the payment schedule, particularly the two SSI payments in May, are not merely administrative changes; they are matters that directly impact the financial well-being of recipients. A clear understanding of these modifications will allow beneficiaries to manage their finances prudently and avoid potential issues. For SSI recipients, amounts range from $715 to $1,450.

Staying informed and proactive will enable you to navigate any changes with greater confidence. Whether you are an SSI recipient or a Social Security beneficiary, knowing the exact dates of your payments and understanding how these payments align with your financial needs will safeguard your financial security and allow you to manage your income effectively.

Remember to consistently check the official Social Security Administration website for any updates and to verify payment schedules as the date approaches. Taking the time to understand and confirm the information will ensure your financial well-being and prevent confusion.